UK Share Market Surges in 2026- FTSE 100 Climbs Amid Rate Cut Hopes and Strong Corporate Earnings

UK Share Market Surges in 2026- The UK share market opened the week on a strong note as investor confidence returned to London’s trading floors, driven by expectations of interest rate cuts, resilient corporate earnings, and improving global sentiment. The benchmark FTSE 100 edged higher in early trading, reflecting renewed optimism across energy, financial, and consumer sectors. Analysts suggest that 2026 could mark a turning point for British equities after a period of cautious volatility.

Market Overview: FTSE 100 and FTSE 250 Show Strength

The FTSE 100 climbed steadily during morning trade, supported by gains in oil majors and banking stocks. Meanwhile, the mid-cap focused FTSE 250 also advanced, indicating broader market participation beyond large-cap companies.

London markets mirrored positive cues from global indices, with investors closely monitoring economic data from both the UK and the US. Trading volumes increased compared to last week, suggesting that institutional investors are gradually re-entering positions after months of defensive strategies.

Market strategists believe that improved liquidity conditions and stabilizing inflation figures are encouraging traders to reassess UK equities, which had previously lagged behind US and European counterparts.

Interest Rate Expectations Boost Investor Sentiment

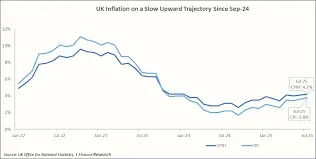

One of the key drivers behind the rally is speculation surrounding the next move by the Bank of England. With inflation showing signs of moderation, economists predict that policymakers could consider rate cuts later this year.

Lower interest rates typically reduce borrowing costs for businesses and households, which in turn can stimulate economic growth. Financial stocks responded positively to the outlook, as investors anticipate stronger lending activity and improved credit demand.

Currency markets also reacted, with the British pound remaining relatively stable against the US dollar. Stability in currency markets has further reassured international investors looking for consistent returns in UK-listed companies.

Energy and Mining Stocks Lead the Charge

Energy giants played a major role in pushing the index higher. Rising crude oil prices supported gains in multinational oil companies listed in London. Mining firms also recorded solid gains amid expectations of stronger demand from emerging markets.

Commodity-linked stocks have traditionally formed a significant portion of the FTSE 100, and their recent performance highlights the UK market’s exposure to global resource trends. Analysts point out that diversification across sectors remains a key advantage of the London Stock Exchange.

Banking Sector Performance Signals Confidence

Major UK banks experienced upward momentum as bond yields stabilized. Investors see potential for improved net interest margins if economic conditions strengthen without triggering further aggressive rate hikes.

Financial experts suggest that the resilience of the banking sector reflects confidence in the broader UK economy. Recent earnings reports have shown better-than-expected profitability, strengthening investor trust in domestic financial institutions.

Tech and Retail Sectors Show Mixed Trends

While traditional sectors surged, technology and retail shares presented a mixed picture. Some tech firms faced pressure due to global competition and valuation concerns. However, selected digital infrastructure companies managed to post gains.

Retailers, on the other hand, benefited from signs of improved consumer spending. Analysts attribute this trend to stabilizing energy costs and wage growth, which are gradually improving household purchasing power across the UK.

Global Influences on the UK Share Market

The performance of the UK market cannot be viewed in isolation. Developments in the US Federal Reserve’s monetary policy and geopolitical events continue to shape global investor sentiment.

Positive cues from Wall Street often translate into gains in London, particularly for multinational companies with overseas revenues. Investors remain cautious, however, about potential global economic slowdowns or unexpected policy shifts.

What Investors Should Watch Next

Market participants will closely monitor upcoming inflation data, employment figures, and corporate earnings releases. Any confirmation of interest rate adjustments by the Bank of England could significantly influence short-term market direction.

Experts recommend diversified portfolios and long-term strategies, particularly in sectors demonstrating consistent earnings growth. Defensive stocks, including utilities and healthcare, are also gaining attention among conservative investors.

Outlook: Is 2026 a Turning Point for UK Equities?

The UK share market appears to be regaining its footing after navigating economic headwinds over the past few years. With inflation easing, corporate profits stabilizing, and global trade showing resilience, analysts are cautiously optimistic.

If current trends continue, the FTSE indices could see sustained upward movement in the coming quarters. However, volatility remains a factor, and investors are advised to stay informed and adopt disciplined investment approaches.

The coming months will be crucial in determining whether the current rally marks the beginning of a longer-term bull phase or simply a temporary rebound.