UK Share Market Today- FTSE 100 Shows Resilience Amid Inflation Pressure and Global Uncertainty

UK Share Market Today- The UK share market displayed notable resilience today as investors carefully navigated persistent inflation concerns, shifting interest rate expectations, and mixed global cues. Despite ongoing macroeconomic headwinds, benchmark indices such as the FTSE 100 managed to hold steady, supported by strength in energy, banking, and defensive stocks. Market participants remained selective, focusing on fundamentally strong companies while keeping a close eye on economic data and central bank signals.

UK Market Overview: A Cautious Yet Stable Start

The UK equity market opened on a cautious note, reflecting uncertainty across global financial markets. However, as the session progressed, buying interest emerged in heavyweight stocks, helping major indices stabilise. The FTSE 100 traded in a narrow range, highlighting investor hesitation ahead of key economic indicators related to inflation and employment.

Mid-cap and small-cap stocks showed mixed performance, with the FTSE 250 experiencing mild volatility. Investors appeared to favour large-cap companies with stable earnings and strong dividend yields, a trend that continues to define the current UK market environment.

Inflation and Interest Rates: The Key Market Drivers

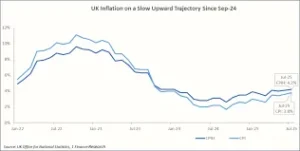

Inflation remains the most influential factor shaping sentiment in the UK share market. Although recent data suggests that price pressures are gradually easing, inflation still remains above the comfort zone for policymakers. As a result, investors are closely watching signals regarding future interest rate moves.

Higher interest rates typically put pressure on growth-oriented stocks, particularly in sectors like technology and real estate. On the other hand, banking and financial stocks often benefit from elevated rates, which explains the continued interest in UK banking shares.

Sector Performance: Energy and Financials Lead

Energy Stocks Gain Support from Commodity Prices

Energy stocks emerged as one of the top-performing sectors in today’s session. Rising crude oil and natural gas prices provided strong tailwinds for major UK-listed energy companies. With geopolitical tensions and supply constraints continuing to influence global energy markets, investors remain optimistic about earnings visibility in this sector.

Banking and Financial Services Stay Firm

UK banking stocks maintained their upward momentum, supported by expectations of sustained net interest margins. While concerns over loan defaults persist, strong balance sheets and improved capital positions have helped banks remain attractive to long-term investors.

Defensive Stocks Attract Risk-Averse Investors

Defensive sectors such as consumer staples, healthcare, and utilities witnessed steady inflows. In times of economic uncertainty, these sectors are often viewed as safer bets due to consistent demand and stable cash flows. Dividend-paying stocks, in particular, continued to draw attention from income-focused investors.

Global Cues and Their Impact on UK Markets

The UK share market did not operate in isolation. Mixed signals from global markets influenced intraday movements. Asian markets closed with marginal gains, while European peers traded cautiously. US market futures also remained subdued, reflecting concerns over inflation data and corporate earnings outlook.

Currency movements played a role as well. The British pound showed limited volatility, which helped reduce pressure on export-oriented companies. A stable currency environment is generally seen as supportive for UK equities, especially multinational firms.

Economic Data and Corporate Earnings in Focus

Investors are actively tracking upcoming UK economic data, including employment figures, retail sales, and manufacturing output. These indicators are expected to provide clearer insights into the health of the UK economy and consumer spending trends.

On the corporate front, earnings updates from major UK companies have been mixed. While some firms reported resilient demand and cost control, others highlighted margin pressures due to higher input and labour costs. As earnings season progresses, stock-specific movements are likely to dominate market action.

Investor Strategy: What Should Market Participants Do Now?

Market experts suggest that investors should adopt a balanced and disciplined approach. Volatility may persist in the near term, but long-term opportunities remain intact for those focusing on quality stocks with strong fundamentals.

Diversification across sectors, a focus on dividend yield, and selective exposure to growth themes such as renewable energy and infrastructure are strategies gaining popularity. Short-term traders, meanwhile, are advised to remain cautious and closely monitor technical levels.

Outlook for the UK Share Market

Looking ahead, the UK share market is expected to remain range-bound until clearer signals emerge on inflation control and interest rate direction. While challenges remain, the market’s ability to hold key support levels reflects underlying strength and investor confidence in the long-term prospects of UK equities.

As global uncertainty continues, the UK market may benefit from its relatively defensive composition and attractive valuations compared to other developed markets. Patient investors could find opportunities during periods of correction.